Healthcare

News and Views

THE OFFICIAL NEWSLETTER OF HEALTHCARE REALTY GROUP

New This Month

Urgent Care Sector Continues to Grow and Evolve

The urgent care market is growing faster than ever before and is projected to reach $40.7 billion by 2027. The increasing demand for urgent care centers is due to several factors, including shifting demographics, rising wait times for primary care service providers, and overrun emergency rooms.

Healthcare Realty Group, LLC – 511 W. Bay Street, Suite 352 | Tampa, FL 33606

Urgent Care Sector Continues to Grow and Evolve

The urgent care market is expected to grow steadily in the coming years, driven by a continued push to redevelop outdated retail space into urgent care facilities and new construction. According to Data Bridge Market Research, “the urgent care market will experience a compound annual growth rate of 5.35% between 2022 and 2029.”

This growth is being driven by a number of factors, including an aging population, the increased prevalence of chronic diseases, and the rising cost of healthcare. In addition, the introduction of new technologies, such as telemedicine, is also helping to drive growth in the urgent care market.

Consumer demand for convenience has reached an all-time high, particularly among younger generations. According to a 2019 Harmony Healthcare IT survey, nearly 25% of millennials haven’t visited a primary care physician (PCP) in five years or more, with about one-third saying that getting a physical just isn’t convenient. For this reason alone, more and more younger patients are opting for urgent care centers that offer walk-in appointments for real-time needs, including COVID testing and non-emergency health issues.

In 2020, urgent care clinics saw a 58% increase in visit volumes due to the demand for COVID-19-related episodic care, according to the latest research from urgent care software company Experity. Of the 28 million patients who visited these clinics in 2020, almost 16 million were seeking care for COVID-19-related symptoms or concerns. Testing and vaccinations accounted for more than 60% of total visits, with testing alone accounting for 42% of all visits. The remaining 18% of visits were for other episodic care needs such as flu or strep throat. The increase in visit volumes was driven by both new and existing patients, with new patient volume increasing by 37% and existing patient volume increasing by 19%.

Investing in Urgent Care Real Estate

As the healthcare landscape changes, investors see urgent care facilities as an increasingly attractive investment opportunity. With hospital access limited due to COVID and continued closures in suburban and rural areas, urgent care centers have become an essential source of medical care. Urgent care centers offer a wide range of services, from primary care to orthopedics, making them a one-stop shop for many patients. In addition, urgent care centers are typically open longer hours than traditional doctor’s offices, making them more convenient for busy families. As a result of these factors, investors are seeing urgent care as a sound investment during this period of uncertainty.

Urgent care centers provide investors with the opportunity to generate stable, long-term income from leased space. These facilities are typically leased to tenants on triple-net leases, which means that the tenant is responsible for all operating expenses.

This provides investors with a predictable and reliable source of income. Urgent care real estate is typically located in high-traffic areas, such as shopping malls or strip malls, providing exposure to potential customers and driving traffic to the facility.

Factors to Consider

When evaluating any real estate opportunities, it is important to do your due diligence in order to ensure a positive return on investment. When it comes to investing in an urgent care facility, there are a few key factors that should be taken into consideration.

The location of the facility is crucial. It should be situated in an area that is easily accessible and has a high volume of traffic. Additionally, the demographics of the surrounding area should be taken into account. The facility should be located in an area with a large population of potential patients.

When choosing an urgent care facility, it is important to consider the size of the facility. The urgent care market is growing, which means that there is a need for larger facilities that can accommodate an increasing number of patients. It is important to choose a facility that will be able to meet the future demand for urgent care services. A larger facility will also have the space to provide additional services, such as on-site laboratory testing and X-rays. In addition, a larger facility will be able to staff more providers, which can help to reduce wait times. Ultimately, the size of the facility should be based on the projected growth of the community and the expected demand for urgent care services.

Finally, it is important to consider the type of urgent care services that will be offered at the facility. There is a growing demand for urgent care centers that offer specialized services, such as COVID testing or telemedicine.

As the urgent care sector continues to grow, investors are seeing it as an increasingly attractive investment opportunity. Contact me today to find out more about urgent care real estate investments.

- Carleton Compton, CCIM

- 813-397-1444

- 813-789-7729

- ccompton@hcrealtygroup.com

- hcrealtygroup.com

Lease/Sale Opportunities

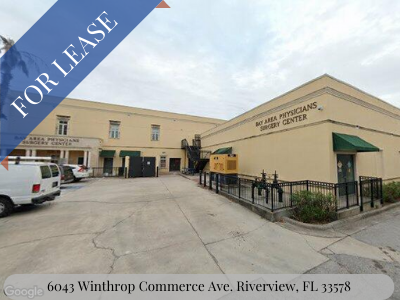

Newly Constructed Surgery and

Overnight Recovery Center

Available Space: 2nd Floor – 2,962 SF

Asking Rate: $23.00 PSF/NNN

Excellent for Medical/Office Use

Available Space:

2nd Floor – 1,016 SF

3rd Floor – 5,213 SF

Asking Rate: $20.00 PSF/MG

- Carleton Compton, CCIM

- 813-397-1444

- 813-789-7729

- ccompton@hcrealtygroup.com

- hcrealtygroup.com

Healthcare Realty Group, LLC – 511 W. Bay Street, Suite 352 | Tampa, FL 33606